Publication - Asset managers, eurodollars and unconventional monetary policy

Copyright: Centralbahnplatz 2

4051 Basel Switzerland

BISBCHBB

Website:www.bis.org

An asset manager's rapid liquidation in the weeks around the end of September 2014 of a very large position in eurodollar futures, a huge derivatives market that allows traders to position on the future path of dollar money rates, raises two questions.

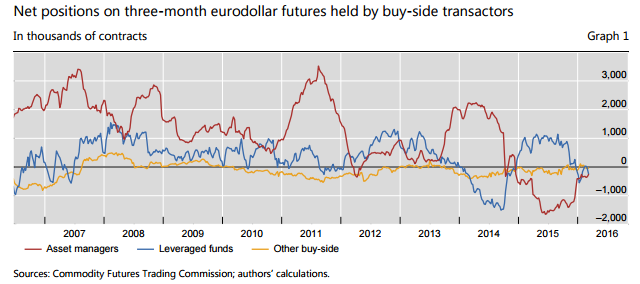

What is the profile of asset managers in this key market? And how has the Federal Reserve's unconventional monetary policy, including forward guidance about policy rates, affected this market? Asset managers generally hold the largest eurodollar positions among buy-side traders but play a lesser role in day-to-day trading. Second, the Fed's unconventional policy saw the average maturity of eurodollar contracts traded between 2008 and 2014 double and it has remained at an elevated maturity since then.

Moreover, from 2012 into 2015 eurodollar turnover responded more strongly to Federal Reserve announcements than to macroeconomic news, a finding analogous to that of Filardo and Hofmann (2014) for yields. In 2015 asset managers took a large short position in eurodollar futures; this unprecedented position would profit if the Federal Reserve's own projections of policy rates ("dots") were realised. Judging from eurodollar futures, asset managers now play an important role in facilitating or hindering the transmission of monetary policy to market rates.

Introduction

In the weeks around the end of September 2014, asset managers (AMs) liquidated a very large long position in eurodollar futures. This position would have paid off in the event that the Federal Reserve’s actual path of interest rate hikes proved to be slower to start and more gradual than foreseen by the rest of market participants and by policymakers in particular.

At its peak during the first half of 2014, AMs’ combined long holdings of $2.2 trillion in eurodollar futures represented one fifth of total open interest – outstanding bets in this huge derivatives market. Most of this long position was to be liquidated in a fortnight. This episode raises two questions. First, what is the profile of AMs in this market? We discuss both overall positioning and trading activity of AMs relative to other buy-side investors, in particular leveraged funds (LFs). It turns out that AMs as a group regularly take on larger positions than do LFs. AMs took on particularly large long positions in eurodollar futures not only in 2014 but also in 2007–2008 and in 2011. Then in 2015 AM positions turned substantially short for the first time even as LFs were long; in effect, AMs were backing the Federal Reserve’s anticipated interest rate trajectory while LFs and most other market participants were betting that rates would not rise so fast.

Second, how has the Fed’s unconventional monetary policy affected the market for eurodollar futures? We examine daily data, but in so doing can only focus on transactors of all types, not just AMs. We analyse the maturity profile of turnover and define a new concept, turnover duration. We find that turnover duration doubled between 2008 and 2014 and remains elevated in comparison to the period 2000- 2007. Our analysis of quantities in the eurodollar futures market complements the work of Filardo and Hofmann (2014) on the effect of forward guidance on prices. Those authors find that forward guidance led to a suppression of short-term money market responses to macroeconomic news, eg no response of one-year forward rates to US payroll news surprises in 2012–14.

Analogously, we find that from 2012 into 2015 eurodollar turnover responded more strongly to Federal Reserve announcements than to employment data surprises. This paper is structured as follows. Section 1 puts the rapid closeout of AMs’ extremely large long position in eurodollar futures in the weeks surrounding 30 September 2014 into the broader context of the role AMs play in eurodollar futures. A box details the concentrated nature of this holding and its liquidation. The second section discusses the maturity profile of eurodollar futures trading and how it has changed since the financial crisis of 2007–08.

The third section analyses how the maturity profile of eurodollar futures turnover has responded to the Federal Reserve’s announcements of large-scale bond buying (so-called quantitative easing or QE) and forward guidance. Another box examines how the maturity profile of eurodollar futures trading has responded to monetary policy announcements by the European Central Bank (ECB), the Swiss National Bank (SNB) and the Bank of Japan (BoJ). The last section concludes.

Copyright: Centralbahnplatz 2

4051 Basel Switzerland

BISBCHBB

Website:www.bis.org

page source https://www.bis.org/